Your Dream Honeymoon for FREE?! It’s Attainable with Points & Miles!

Let’s face it – weddings are expensive. The average cost of a wedding in in the US in 2023 is $29,000 (and even more in major cities), so adding on the price of an epic honeymoon to that can feel overwhelming or unattainable. Luckily, if you play your (credit) cards right during the wedding planning process, using points & miles for your honeymoon and going for nearly free is very achievable.

I just got married in June, and while the pandemic meant my husband and I had a very untraditional journey to the altar, I also was able to take my time and learn the ins and outs of squeezing the most points from every dollar. If you’re engaged or plan to be, implement these strategies early and often and you just might find yourself relaxing on the honeymoon of your dreams FOR FREE.

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my link, at no extra cost to you.

ACCUMULATING THE POINTS

Open Cards to Earn Welcome Offers

In the world of points & miles, credit card welcome offers are the quickest way to rack up tons of points. However, to get these, you usually have to spend thousands of dollars within the first few months. For many people, their regular spending isn’t enough to get the SUB, so big one-time expenses (like a wedding) are a great opportunity to get rewards you wouldn’t normally be able to earn.

To keep your credit score healthy, you should aim to wait at least 3-4 months between opening cards. Since most couples take about 12-18 months to plan their wedding, this is plenty of time to open a handful of cards.

Keep timing in mind as you strategize card openings. If all your payments are due a year out and then 1 month out, you won’t be able to get any SUBs in the middle. Spreading out your payments can really pay off here.

[Related: Chase 5/24 Rule Explained]

Start with the End Goal in Mind

Using points & miles to fund your honeymoon is going to look different for everyone. To ensure you can use points, solidify where you want to go early on. Earning points at random may mean you wind up with points that can’t get you where you want to go.

If you want stay at the luxurious St. Regis Bora Bora, you’ll need to make different decisions than if you want to stay at the Hyatt Regency Kāʻanapali. That’s because St. Regis is a Marriott brand and thus a competitor to Hyatt. The airlines you’ll want to take will probably differ between Tahiti and Hawaii as well.

In the example of Hyatt Regency Kāʻanapali, signing up for one of the Chase Sapphire cards is a great starting point since Hyatt is a transfer partner (and so is Southwest, which flies to Maui). Beyond that, cobranded cards like the World of Hyatt card earn you more points towards a free stay. You could also apply for a Southwest credit card and work towards earning the coveted Companion Pass so your new spouse can fly for free.

[Related: Southwest Companion Pass explained]

Additionally, there are some destinations where it’s simply harder to use points. Iceland is one of the most amazing places I’ve ever been, but there’s not a lot of major airlines that fly there and not many hotel chains (especially outside of Reykjavik). There are still ways to use points towards places like this, but just know it won’t yield as much value as other destinations. To use points, the main methods would be to book through the credit card travel portals or to use features like the Capital One travel eraser to cover some of the costs. On the upside, redeeming points this way is simpler and may be less intimidating to those starting out.

Two Player Mode

One of the most lucrative strategies to earning free trips is also one that works extremely well for couples: Two Player Mode. Essentially the concept is that you apply for a credit card and earn the welcome offer. Then, you refer your “Player 2” to that card and when they earn the welcome offer you also earn a referral bonus.

Two Player Mode also allows you to apply for more credit cards between the two of you. If Player 1 applies for cards in January, May, and September, Player 2 can apply for cards in between in March, July, and November (assuming spending for SUBs can be met quickly enough). This way the two of you are always working towards the next SUB without hurting either person’s credit.

[RELATED: What to consider before adding authorized users]

Strategizing Bonus Category Spending

When you’re not working towards a welcome offer, strategically using certain cards for specific things can help your points grow faster. Here are 3 examples of where I chose to use certain cards on wedding expenses:

- My wedding was at a hotel and all venue, food, and beverage costs went through them. It coded as “travel,” so I used my Chase Sapphire Reserve card and got 3x points on my single largest wedding expense.

- There are a lot of random things I purchased on Amazon (ex. table number holders, glow sticks for the dance floor, etc.). When I would go grocery shopping, I’d throw a $50 Amazon gift card in my cart and earn 4x points on it using my Amex Gold card. Note: I kept these gift card amounts low and always purchased other items with it so as not to be flagged as suspicious to the bank.

- When paying vendors by card, I made sure to use my Capital One Venture X to earn 2x points on services that would normally code as 1x on most other cards. The Venture X earns a minimum of 2 points per dollar spent regardless of category.

Choose Vendors Who Accept Credit Cards

I am going to preface this by saying that above all, it is most important to find vendors you like and trust, because great vendors can make or break your special day. I am so thankful every single one of my vendors knocked it out of the park on my wedding day and I’d re-hire them all again.

With that in mind, when you’re looking for vendors and jumping on consultation calls with them, be sure to ask what payment methods they accept and whether or not they charge additional fees for using a credit card. I found 2 amazing DJs who charged the same price and who I thought would do a great job. Only one of them accepted credit cards (and didn’t charge any fees), so I ultimately went with him. I did have to pay by check/Venmo/Zelle for a couple other vendors who didn’t accept cards.

There is one case where it may be worth it to pay the additional credit card fee and that’s if you’re not able to hit the minimum spend for a welcome offer without that purchase. The small 2-3% fee that you’ll pay is much less than the value of the large SUB you’ll earn.

Fronting the Costs

If your parents, grandparents, etc. are offering to generously help cover some of the wedding expenses, see if they’d be willing to write you a check up front or pay you back after you’ve made the purchases. That way you can put the spending on your card and earn the points.

Alternatively, it’s likely you’ll run into at least one vendor who doesn’t accept credit cards. If that’s your florist, for example, see if your parents (or whoever) would be willing to pay for the flowers specifically. Then you spending can be more focused on point-earning opportunities.

This same concept goes for your bachelor/bachelorette trips. If you are helping plan and pay for these trips, offer to book everything and have your friends pay you back so you come away with all the points.

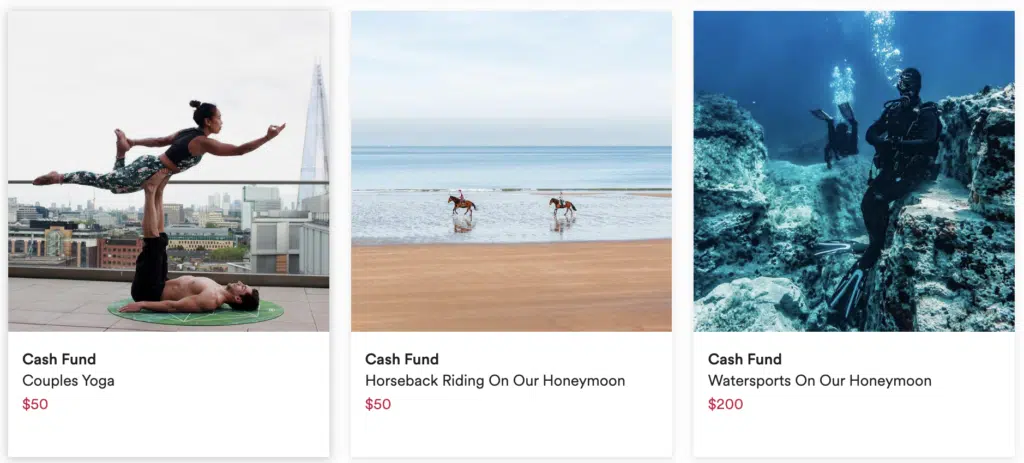

Utilize a Honeymoon Fund for Miscellaneous Expenses

Not every aspect of a trip can be paid for with points. While things like hotels, flights, and even rental cars can be covered, you’ll likely still have to pay cash for things like food and excursions. These can add up quickly – in the Maldives, a luxurious floating breakfast in the pool can easily cost $150 or more!

This is where your wedding registry can be very helpful. You can register for gift cards or cash funds where you guests can help cover these miscellaneous costs. Now, I know not everyone feels comfortable giving cash. However, framing the gifts like “a couples massage” or “scuba diving excursion” may make guests feel better about the idea since they know exactly what their money is going towards.

Utilize Credit Card Offers and Shopping Portals to Save

The ultimate goal here is to save money, so spending more money just to earn the points rarely makes sense. As you’re going through the entire wedding planning journey, look for ways to save. If you’re able to come in under budget, (first of all that’s amazing and I’m jealous) you’ll have more money left over for the honeymoon or just starting your lives together.

Here’s an example of an offer I see on my Amex cards all the time:

If you’re not yet engaged (or just shopping for jewelry to wear on your wedding day), this is a great example of how you can save money on the things you’re already planning to purchase.

BOOKING THE TRIP

Now that you’ve accumulated all the points you need, how do you go about actually planning the trip? This is often the most intimidating part of using points for your honeymoon, but it gets easier with practice!

Timing

Ideally, you’ll be able to pick a destination early but stay flexible on dates. Not every date is available to be booked on points or it might cost more on certain days. A lot of people want to take their honeymoon immediately after the wedding, but it takes time to accumulate points and often it’s best to book far in advance to ensure availability. Thus, delaying the trip might be necessary to go for free. Alternatively, one option is to pay for your honeymoon with cash and use the points towards another trip later on.

Award flights typically open 11-12 months out (less for Southwest), and the best seats and dates tend to get snagged quickly. If you want to fly out on a Saturday in business class, book early.

Research your destination’s peak travel season and try to book on the edges (aka “shoulder season”) to help save on costs. You’re also fighting against less demand during shoulder season! Be sure to factor in holidays, both at home and in your destination.

Pooling Points Between Accounts

With Two Player Mode, your points will likely be spread out between you and your partner. There are a few ways to go about utilizing these points together:

- Some credit cards (ex. Chase) allow you to transfer points to another person in the same household.

- You can add each other as authorized users to be able to transfer points (but be sure to consider the pros/cons first).

- Some hotel programs allow point pooling. For example, you can transfer up to 100,000 Marriott Bonvoy points to another person per year (and receive up to 500,000). If you both have Amex points, you can both move them to Marriott and then easily transfer from one person to another through the Bonvoy program.

- You can divide and conquer bookings. Player 1 may book the flights with their points and Player 2 may use theirs for the hotel. You can use your points to book flights/hotels for anyone and can book multiple seats on the same reservation.

Transfer Points to Partners

You’ve worked so hard on your honeymoon and earn all your points, so don’t overpay for flights or hotels! Credit card points go much further when transferred to partner airlines and hotel programs. A flight that costs $1000 would cost 100,000 points in a credit card travel portal, but the airlines may only charge 40,000 points. Transferring your points is the best way to get the most value out of your points and stretch them further.

Transferring points is a large topic of its own. If you want to learn more about transfer partners, check out my guide here.

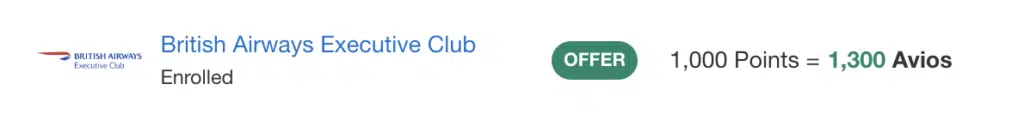

Transfer Bonuses

Occasionally you’ll see offers for transfer bonuses, where you can transfer points from a bank to an airline/hotel and earn more points. For example, Amex currently has a 30% transfer bonus to British Airways. So for every 1000 Amex Membership Reward points I transfer, that becomes 1300 British Airways Avios points.

You can’t predict when transfer bonuses will happen (or if they will at all), so it’s best not to count on it. However, always check if there’s a transfer bonus going on before booking your flights. You might find that you’re able to book the flight you wanted for less than expected.

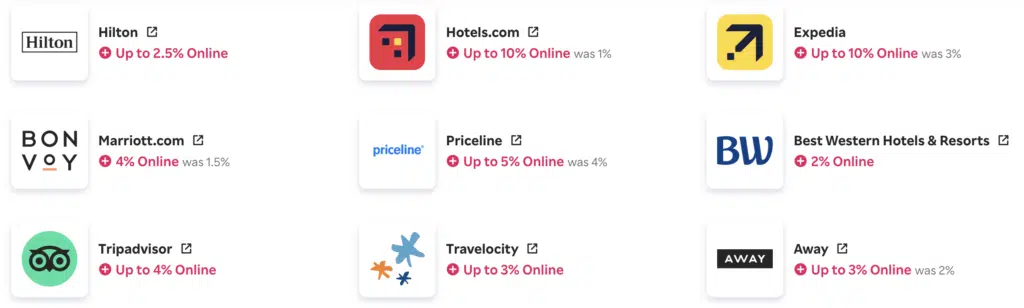

Shopping Portals and Offers

When booking your excursions, look for credit card offers and use shopping portals like Rakuten to earn cash back or Amex Membership Rewards points. Earnings rates will fluctuate day to day, but it’s not uncommon to see upwards of 12% back on Viator during Prime Day in July or Black Friday in November. That can add up to some significant savings on once-in-a-lifetime experiences.

Also, check your credit card offers often to see if you can earn points or cash back on everything from flights and hotels to rental cars to excursions. These can even stack with shopping portals!

[Related: Why Rakuten is my favorite shopping portal]

FINAL THOUGHTS

After months (or years) of planning a wedding, you deserve to relax and enjoy time with your new spouse. Whatever kind of travelers you are, you can absolutely earn your dream trip for free.

And the best part, it’s doable no matter what your wedding budget. Your nearly free honeymoon just requires some strategy and advance planning. Hopefully this guide can serve as a jumping off point to your wedding planning journey. If you have questions, drop them down below!

You may also like: