Rakuten: Why It’s My Favorite Shopping Portal

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my link, at no extra cost to you.

If you do a lot of online shopping and you’re not taking advantage of a shopping portal, you’re leaving money (or points) on the table. I’ve touched on shopping portals in a previous post, but those were airline-specific shopping portals, meaning the points earned were tied to that specific airline. This type of shopping portal has its place, such as if you’re really loyal to one airline or if you need to keep your airline miles from expiring (like I did with American Airlines earlier this year), but the value of your rewards is pretty limited overall. Additionally, Chase has their own shopping portal if you have an Ultimate Rewards-earning credit card, but it is really annoying to use because you log in to your Chase account every time and follow a lot of pages before you can start shopping. Capital One has one too but only earns you cash back, not points (and that cash back is in the form of “shopping credits” not statement credits).

Enter Rakuten. Formerly known as eBates, Rakuten offers 2 forms of payments: you can either get cash back (in the form of a “Big Fat Check” mailed to you or through PayPal) or if you have an Amex Membership Rewards-earning credit card (i.e. the Amex Platinum, Gold, Green, Everyday, or Blue cards), you can get Amex points as long as you change your payout method before making purchases. I’d heard of Rakuten before and seen their commercials but always thought there was a big catch or that it was sketchy – turns out it’s not and I missed out on savings by not signing up sooner. If you’re wondering how Rakuten makes money, that’s such a common question, they put the answer right on their homepage:

For those with no Amex card, the cash back option is a great deal, putting real (and sometimes significant) money back in your pocket for doing the shopping you’re going to do anyways. With an Amex card, the rewards become even more valuable because they are converted to Membership Rewards points, which can be transferred to many different airlines and hotels and be used to book travel at great redemption rates beyond the cash value of the points.

Let me show you an example. In my account, it currently shows that I have $207.01 worth of cash back at Rakuten, which will convert to 20,701 Amex points, which at worst I should be able to redeem for about 2 cents/point, making them worth at least $414.02 in travel. When I booked flights on Air France a couple months back, I was able to transfer my points for a redemption rate of 4.9 cents/point. That would make the same $207.01 in cash back worth a whopping $1,014.35! And all of this is earned ON TOP of the credit card points I earned when I bought the items to begin with. Did I mentioned I only signed up for Rakuten 2 months ago?!

Because there are so many competing shopping portals, I recommend using a site called cashbackmonitor.com to do a quick comparison for the store you’re shopping at to make sure you’re getting the best rewards. However, keep in mind that airline points are considered to be worth less than Amex points because they are not transferable to other programs, so unless the offers are significantly different, I recommend sticking with Rakuten. As with all shopping portals, the cash back offer at any store fluctuates day-to-day, but Rakuten has had some amazing offers recently, including 20% at nearly every store on Black Friday and many stores are still showing 10% cash back. Not every store offers a strict percentage return – some offer a set cash amount (ex. AARP offers $20 back when you spend $40 or more) or divide their rewards based on purchase type (ex. Ticketmaster offers higher rewards on resale tickets than regular ones).

Another big way Rakuten differs from other shopping portals is that they only payout your cash/points 4 times/year, which take place about 45 days after the end of each quarter. Thus, this portal requires a little more patience than others that give you your points on a regular basis, but given how much more valuable Rakuten can be than others, I think it’s worth the wait.

The easiest way to use Rakuten is to add it as a browser extension. Then, it will automatically pop up in the corner on any website where it offers rewards and all you have to do is click to activate the offer (note: you must active the offer before checking out to get the rewards). Using the extension makes it harder to forget your rewards. I’ve even seen the extension recommend buying the same item at a different store where it’s listed for a lower price, doing the comparison shopping for you!

You can also use Rakuten for some in-store offers. Detailed instructions on how to access this cash back in-person can be found here. Much like the Mileage Plus X app that I’ve written about before, you can also buy gift cards on Rakuten to earn rewards.

If you’re interested in signing up for Rakuten, you can click here to get $30 cash back when you sign up and make a $30 qualifying purchase within 90 days (and you’ll still get cash back on that purchase!). If you’re still wrapping up your holiday shopping (or just looking to get something for yourself), this is a great way to put a little extra cash or points back in your pocket. Full transparency: if you use my link, I will also get $30, so it’s a win-win for both of us.

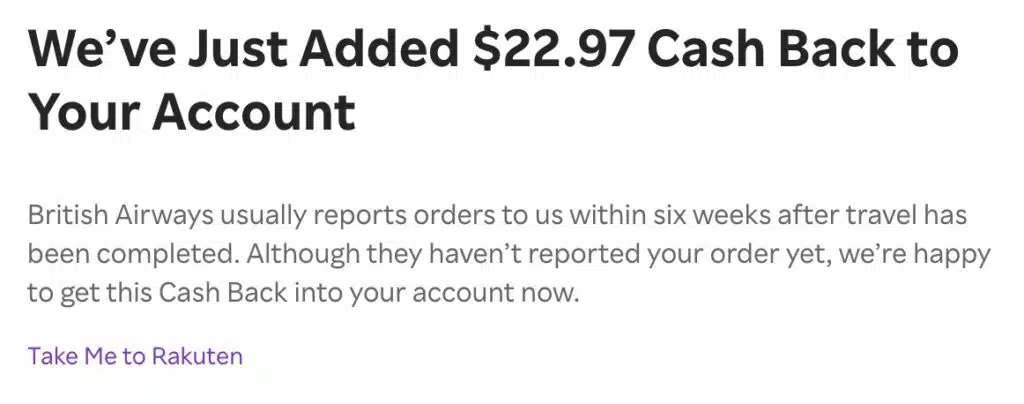

The only downside I’ve experienced with Rakuten is that not every purchase has gotten automatically counted despite my shopping trip showing up in my Rakuten history and knowing for sure I activated the rewards. I’ve noticed this consistently happens with Ticketmaster (BOOOO) and a few other stores. Luckily, you can go to the Rakuten Help Center and provide info about your purchase and they’ll give you the rewards you earned. I’ve done this several times and always been successful. Some companies do take several weeks to report their data to Rakuten, so sometimes all it takes is a little patience.

Travel hacking is more than just massive credit card sign-up bonuses – it’s also finding little ways to save a few dollars or earn extra points here and there. Over time, the seemingly insignificant numbers start to add up to real tangible value, like free business class flights around the world!

You may also like: