Making Money on High Fee Credit Cards

It’s easy to look at credit cards with high annual fees and immediately dismiss them in favor of low- or no-annual fee cards, but if the card is a good match for you* then you may be able to come out ahead of the annual fee.

*I want to emphasize that not every card is the right fit for every person and there is no single best credit card out there. Your spending habits, your goals, and the cards you already have in your wallet are all guiding factors in helping you find the right card for you.

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my link, at no extra cost to you.

You probably know that with a travel credit card you can earn points to be redeemed for free flights, hotels, etc., but the amount of points you earn is based on how much you spend, so I want to focus on all the ways to get your money’s worth out of high-fee credit cards that are irrelevant of total spending. I’m also not considering the sign-up bonus, as that’s a one-time perk. I’ll go through the math my highest-fee credit card to break down the real monetary savings I get out of the cards, all points aside. The real value includes the perks I actually use, not just the dollar value of every card benefit as several are irrelevant to me.

Actual Savings Breakdown

The American Express Platinum credit card has a whopping $695 annual fee, but it also comes with lots of perks. Here’s the breakdown of my savings in 1 year with the card for the perks I ACTUALLY use:

- $200 hotel credit on select prepaid hotels booked through the Amex travel portal. Booked our stay at The Duniway in Portland to get this credit.

- Automatic Gold status at Hilton and Marriott. During my stay at the Duniway, this got me free breakfast ($60 value) and $100 food/beverage credit (which we used $90 of).

- Walmart+ membership (valued at $98 annual fee or $13/month). I don’t use Walmart+ so I wouldn’t normally count this towards the overall value extracted from the card, but being a Walmart+ member gets me a free Paramount+ membership (valued at $50/year or $5/month) AND a one-time $15 Lyft credit and I have taken advantage of both of those.

- $15 monthly Uber credits + an additional $20 in December. I would say I use this roughly 2 out of every 3 months, so let’s estimate the savings to be $120.

- $200 airline credit – this credit is a bit tricky to use as you have to select an airline and then the credit reimburses you for incidental expenses like check bags or paid food/drink on the plane. However, I have selected Southwest as my airline and gotten reimbursed for the $11.20 taxes from Companion Pass bookings. I will almost certainly max this savings out.

- $20/month entertainment credit. Eligible subscriptions include Audible, Disney+, Hulu, New York Times, Peacock, and Serious XM. The only one I subscribe to is Hulu, so I save $14.16/month ($169.92/year).

- $179 in Clear membership savings. I wasn’t going to pay for this before I had the credit, but I do enjoy having Clear and use it whenever possible, so it’s a bit ambiguous what the real value of this is to me.

- Free food in lounges. On our flight back from Seattle in August, we spent several hours in one of the lounges we got access to with the Priority Pass and had coffee, soda, snacks, and lunch there. I’m not sure the exact dollar value of these, but given we were in an airport, we almost certainly saved at least $30 if not more. We usually don’t go to airport lounges because we often arrive to the airport RIGHT before boarding (because we like living dangerously), but I’ll guess we’ll use it at least 4 times/year (estimated savings: $120).

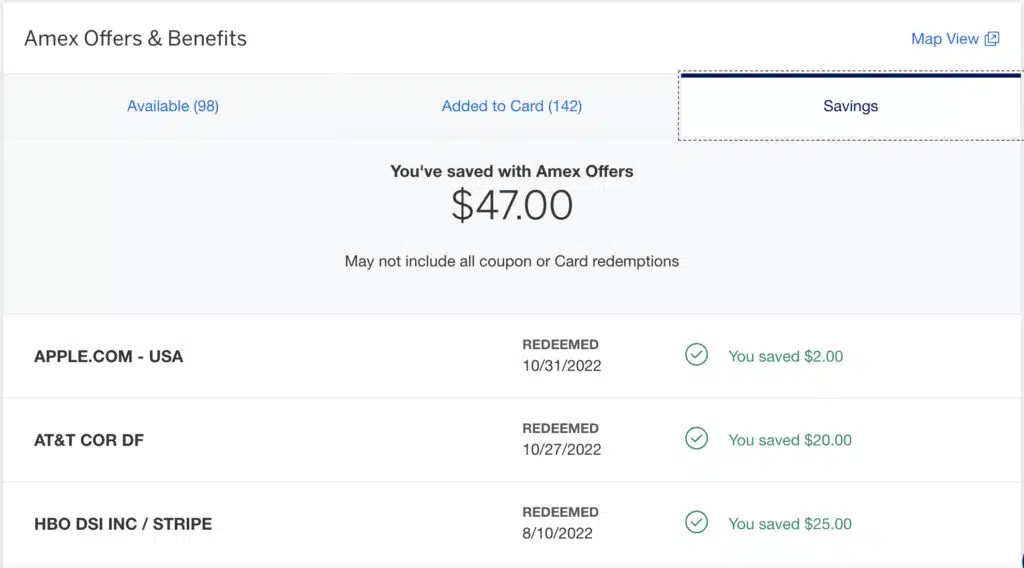

- Amex offers are hit or miss but worth registering for on a regular basis if there’s even a chance you may shop at any of these stores. So far, I’ve saved $47 and earned extra Membership Rewards points (which are not tracked in the savings tab).

If you add all that up, the estimated savings comes to $1,250.92, well beyond the annual fee. This value is what will keep this card in my wallet indefinitely regardless of if I continue to put spending on this card. These are also only the perks I actually use, but the Amex Platinum offers even more.

Not only does this $1,250.92 total not include the points earned on this card and the value they hold when redeemed for free travel, but it also doesn’t take into consideration other perks that can come up by being a card holder. One example of this is special entrances at sports stadiums and events like the US Open or access to hard-to-get reservations at popular restaurants (I used my Amex perks to get a reservation for Thomas’s birthday at a Michelin star restaurant when the regular site was showing it was fully booked). These VIP perks may not have monetary value to you, but when you’re able to take advantage, they do make life just that much better.

If you’re in the market for a new credit card, take your time and look beyond the annual fees. Explore all the benefits of each card to find the best next addition to your wallet.

You may also like: