Credit Card Transfer Partners Explained

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my link, at no extra cost to you.

Earning points is important, but it’s really only half of the equation. Once you’ve racked up the points, how can you redeem them? That’s where transfer partners come in. You can redeem your points directly in the bank’s travel portal, but I BEG YOU not to – you get such a bad redemption rate, it’s a huge waste of your hard-earned points in almost all cases. You’ll only get 1-1.5 cents per point in the portal, but if you take some time to learn how to transfer your points externally and your points will go so much further.

Transfer partners are airline and hotel programs that have teamed up with your credit card company and allow you to transfer points to them.

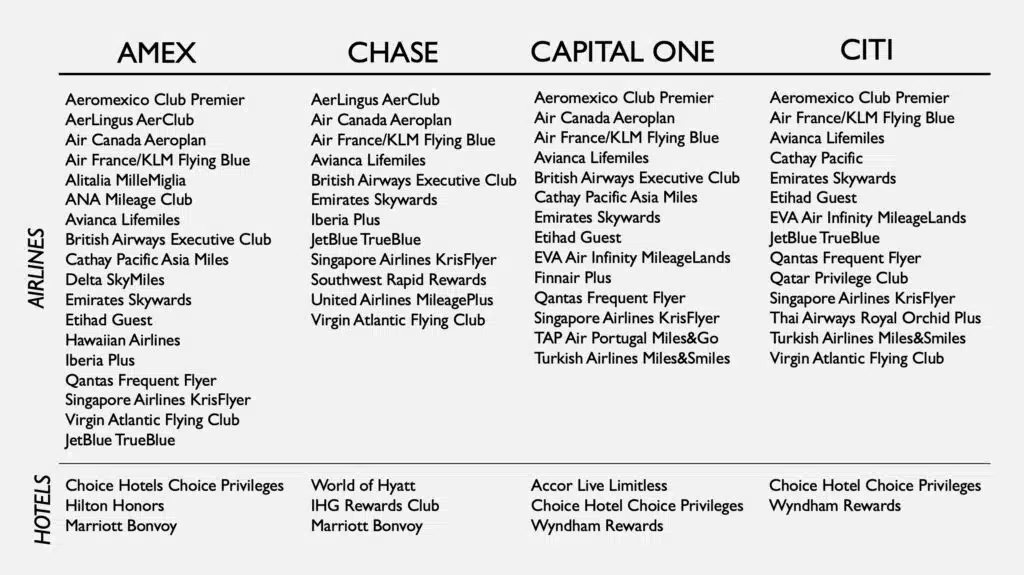

Here’s a quick list of the 4 biggest credit card companies (in the US) and their transfer partners:

(Note that there are a couple other programs, such as Bilt Rewards and Marriott, that allow you to transfer points to other programs as well.)

Picking the Right Card(s) for You

There are so many factors to consider when picking a credit card, but when it comes to flexible travel credit cards, it’s important to consider where you can transfer your points to see if the card is a good fit for you.

Consider the airlines you are already loyal to, have status with, or have a hub near you. Also think about where you want to travel and what airlines can get you there (but more on this in a minute).

If you are like me and fly Southwest a lot, then a Chase card just might be for you since it’s the only card that transfers to Southwest Rapid Rewards. However, if you’re dead set on booking one of Etihad’s famous first-class seats with points, you may want to consider Capital One. Your strategy will also differ if you only want 1 credit card or are looking to build a portfolio in your wallet.

Thinking Beyond the Airline

Now before you get upset thinking these transfer partner lists are restrictive, let me explain where airline alliances and codeshares come in. Basically airlines team up with each other and you, the customer, get to benefit.

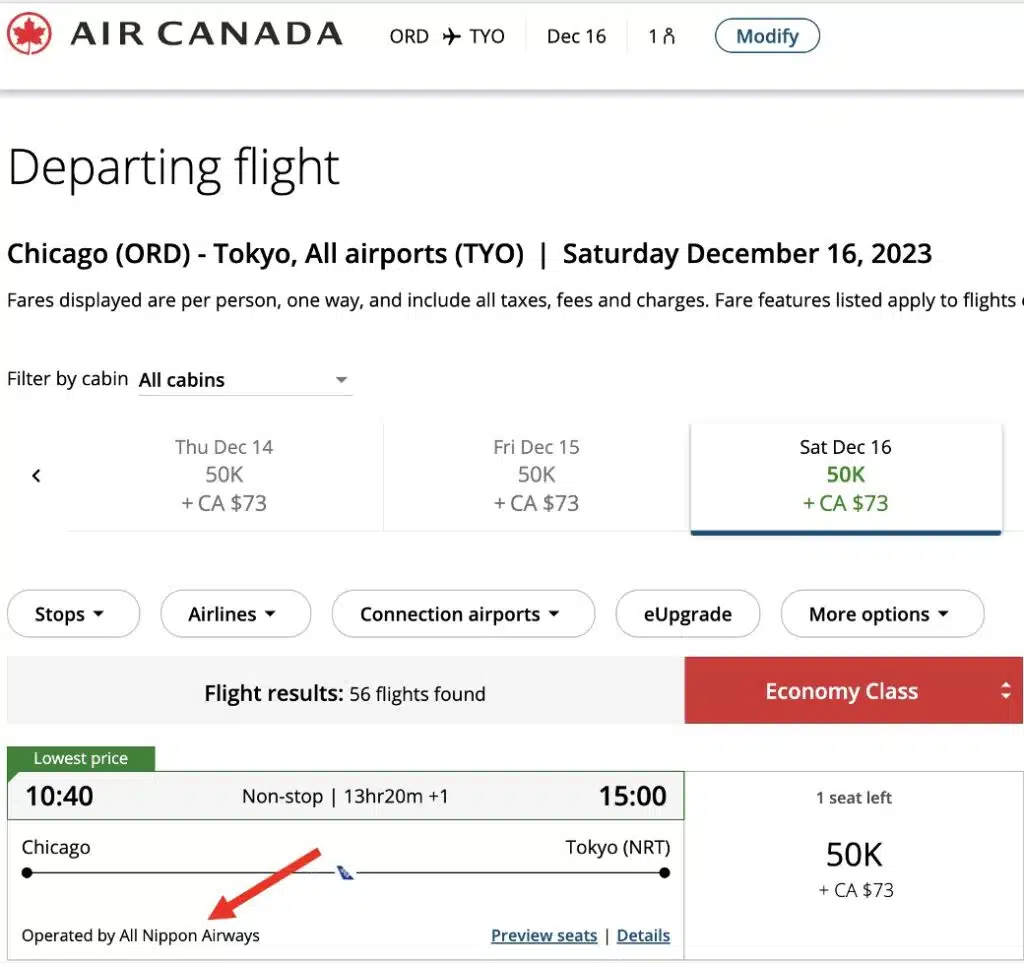

Here’s an example: I booked a flight for later this year to fly business class on EVA Airlines from SFO to Singapore with Amex points. Amex isn’t a transfer partner with EVA, but I booked the flight through Air Canada’s Aeroplan website and transferred the points from Amex to our neighbors to the north. EVA and Air Canada are both members of Star Alliance, so you can book flights for one airline on another’s website. However, it’s not guaranteed that the same award availability will be offered through every alliance partner – ex. Singapore Airlines is known for keeping most of their award availability for themselves and only releasing a couple per flight to partners.

As an American, I was concerned with how I could book domestic airlines with each bank’s transfer partners, as many are limiting. United flights can be booked through Star Alliance carriers such as Air Canada Aeroplan and American Airlines tickets can be booked through British Airways.

Just because a flight is offered on multiple websites doesn’t mean it will be the same price everywhere (either in cash or points), so it’s always important to search among all potential airline websites to make sure you’re getting the best deal. I just booked an award flight to Switzerland on AerLingus and the flight was the same number of points on both AerLingus and British Airways’ websites, but the taxes and fees were $200 higher on BA’s site!

Side note: the other cool thing about AerLingus, British Airways, and Qatar Airways that they all use Avios as their point currency and you can transfer the Avios between these airline accounts – that means even though Chase isn’t a transfer partner of Qatar, you can get your points there through a transfer to British Airways and then another transfer to Qatar Airways.

Don’t Transfer Until You’re Ready to Book

Once you transfer points out of your bank to a partner program, you can’t reverse it, so you need to be careful and only transfer points once you’ve found a flight or hotel you want to book. With flights, it’s best to be on the safe side and call to confirm the award availability because there’s nothing worse than transferring your valuable points only to find out the one you wanted was phantom availability (aka a glitch in the system – some airlines are more notorious for this than others).

As mentioned, you’ll want to make sure to shop the flight around to all potential transfer partners before you move your points to make sure you’re getting the best deal. Even though a flight can be booked on multiple airline sites, the points cannot be transferred from one airline to another (Avios is an exception).

Transfer Ratios and Bonuses

If we think about various points/miles programs as different currencies, you can understand that not every point is worth the same. This is why searching through multiple programs is important, but it goes beyond that. Not every program transfers from bank to airline/hotel at a 1:1 ratio. Most do, but not all. For example, Amex transfers to Aeromexico at a 1:1.6 ratio, meaning for every 1000 points you transfer out of Amex, you get 1600 Aeromexico Club Premier points. Some ratios, like this Aeromexico example, work in your favor, but others go the other way – Capital One points transfer to Accor at a 2:1 ratio, so if you transfer 2000 Capital One points, you only get 1000 Accor points.

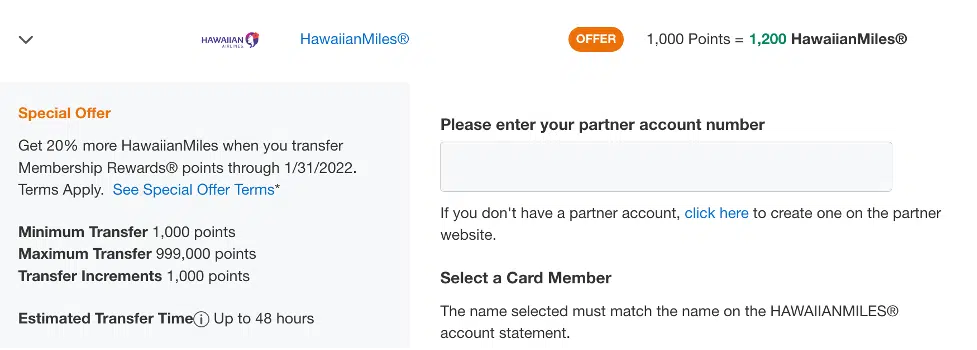

These ratios can also temporarily change for certain programs when they are offering transfer bonuses. Some months may have several offers and others very few – right now Amex’s only transfer bonus offer is a 20% bonus with Hawaiian Airlines.

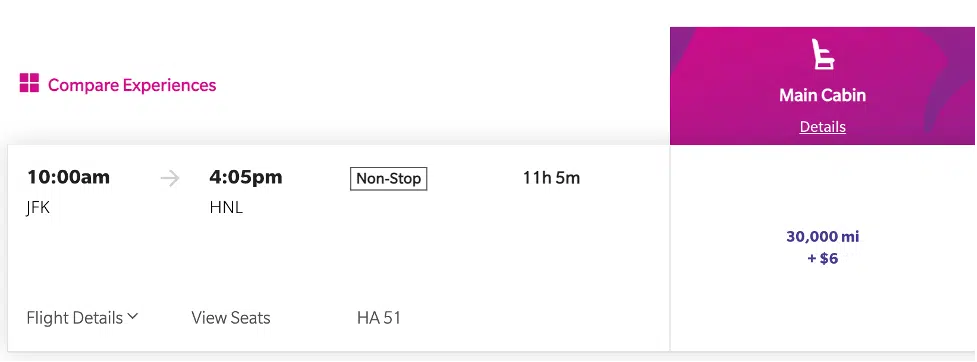

You can book a flight from JFK to Honolulu for 30,000 points (+$6 in taxes and fees). With this transfer bonus, you’d only need 25,000 Amex points to get the requisite HawaiianMiles. Transfer bonuses can be powerful and tempting, but you should only take advantage of the offer if there’s actually a flight you want to book – don’t just transfer your points hoping to use them later because having points in one specific airline program is very limiting.

How to Transfer

After you have honed in on the flight you want, it’s time for the critical step of transferring those points from your bank to the airline. Each transfer partner has a set minimum number of points you must transfer and a stated increment transfers must be made in. From the Hawaiian example, you must transfer at least 1000 points and can only transfer in increments of 1000. That means if you needed 20,500 points for a flight, you must transfer 21,000 – the extra 500 points would stay in your airline account for use on a future flight.

Unfortunately, not every transfer will happen instantly, though most will. If it’s your first time transferring from your bank to that specific airline, it may take longer than normal. There are also some airlines with stated longer transfer times, including Hawaiian Airlines and Singapore Airlines. When I transferred points to Singapore Airlines, I knew it could take up to 48 hours, but luckily it only took about 2 hours. I’m not naturally a patient person, so this was annoying to me, but even more so because as you wait you risk the award seats getting snagged and then your points are stranded with that airline.

You can choose to transfer points to either your own airline/hotel account or those of an authorized user on that credit card. For some cards, there’s a waiting period between adding an authorized user and them being eligible to transfer points. This feature is handy if you’re trying to pool points with someone else for a redemption.

Transferring your hard-earned points can be really scary but taking your time to understand the process and your options will hopefully leave you empowered to book your first flight with points! And if you ever have any questions, my inbox is always open.

You may also like: