Chase 5/24 Rule Explained – Everything You Need to Know

Did you know the order you get credit cards matters? And it doesn’t just matter for maximizing your points or how many business class flights you can book. The cards in your wallet can determine if you’re approved for your next card. The Chase 5/24 Rule is important to understand so you can confidently navigate the world of travel hacking, credit cards, and sign up bonuses.

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my link, at no extra cost to you.

What is the Chase 5/24 Rule?

The Chase 5/24 Rule states that if you have signed up for 5 or more credit cards in the past 24 months, you will be denied if you apply for a Chase card (both Chase-specific and Chase co-branded cards). These 5 cards aren’t just Chase cards – they’re any personal credit cards. So for example, the Amex Platinum, United Explorer, Chase Sapphire Preferred, Citi Premier, and Capital One Venture X would all count towards 5/24 status.

Even if you’re under 5/24, your application can certainly still be denied for other reasons, but the Chase 5/24 rule will guarantee you a denial if you go over.

Why does this matter?

If you only sign up for one credit card every few years, this rule won’t ever affect you. However, if you’re more serious about travel hacking and using sign up bonuses to build up your stash of points, this rule will quickly bar you from the world of Chase cards.

Obviously, this is a genius marketing tactic by Chase to encourage you to sign up for their cards first. And it works! I am always pretty mindful about where I stand in regard to 5/24, which cards I’m interested in opening next, and planning accordingly.

Does Being added as an authorized user Count against me?

Yes, being an authorized user on someone else’s card counts towards your 5/24 status. That’s why I generally don’t recommend being someone’s authorized user unless they want the flexibility to transfer their points to your airline/hotel accounts. (There are a couple other use cases for being an authorized user but that’ll be its own post).

However, there is some anecdotal evidence on the internet that the only reason you’re denied a new card is because being an authorized user puts you over 5/24, you can call the Chase reconsideration line and they may approve you. This is not guaranteed.

Here are those Chase reconsideration numbers for reference:

- Personal: 888-270-2127

- Business: 800-453-9719

If I close a credit card, does that open up a slot?

Unfortunately, closing a card still counts it towards your 5/24 status. The rule is based on when you’ve opened cards and doesn’t consider any activity beyond that.

I was denied for a card. Did that still take up a slot?

While it stinks to be denied for a card, it won’t count against you. (Also, if you are denied, try calling the bank’s reconsideration line!)

Do business credit cards count towards 5/24?

The answer here is “it depends” (a common answer in travel hacking).

Business cards do not count towards your 5/24 status, but in order to sign up for a Chase card, you still must be eligible under 5/24. This only applies to Chase business cards, not those from Amex, Citi, or any other bank.

For example, if you want to open the Southwest Rapid Rewards® Premier Business Card (a Chase co-branded card) and have opened 5 personal cards in the past 24 months, you will be denied. However, if you are under 5/24, you can be approved and if you are, you will still have the same number of slots left.

How do I track my 5/24 status?

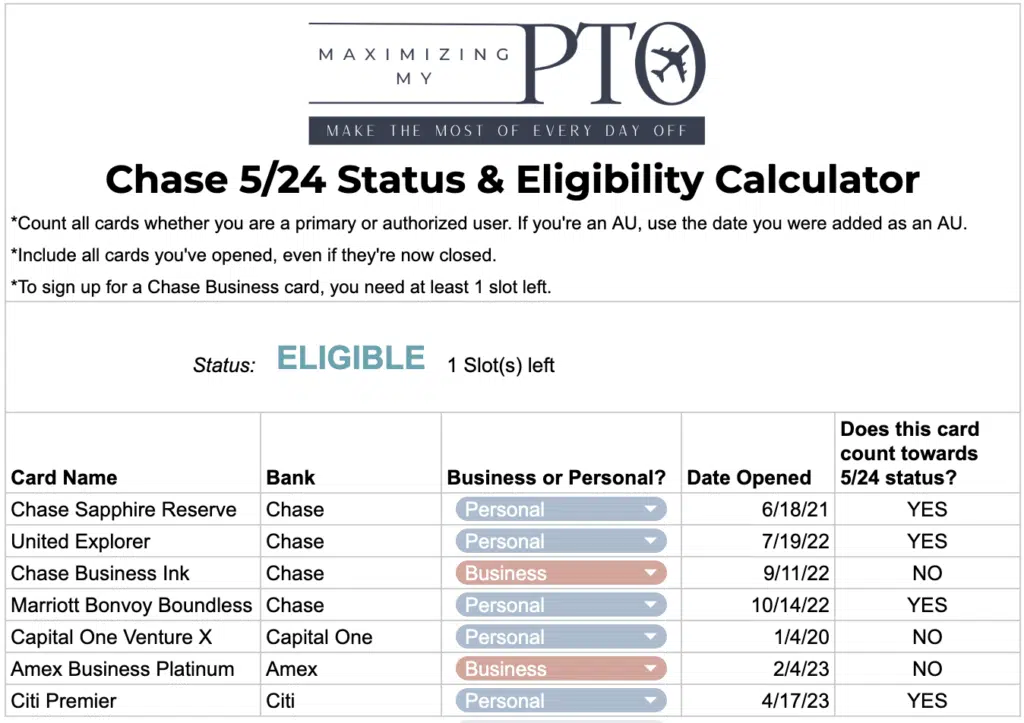

I have created a free resource for you to calculate how many slots you have left 5/24 rules or know when you’ll be eligible if you have no slots left.

How to use the calculator:

- This is a view-only document, so click “File” > “Make a copy” to create an editable version for yourself.

- Delete all the cards listed as examples and re-add your own. Note: Column E populates automatically, so no need to edit it.

- To find what dates you opened cards, you can search your emails for confirmations sent from the bank. Or search in your bank account to see when your first purchases were made (in this case the date won’t be 100% accurate but it should be close).

- After you enter info in columns A-D, column E and the 5/24 status at the top will automatically calculate.

- You can save this document and continue to update it as you get more cards.

If you have any questions about this calculator, feel free to reach out to me!

Update: Is 5/24 dead?

There’s been recent anecdotal evidence that Chase is not strictly enforcing the 5/24 rule anymore. Check out this Daily Drop article to learn more. Bottom line: the rule may be becoming more of a discretionary guideline than a hard line in the sand.

My Personal Strategy

Some people are adamant about filling all of their 5/24 slots before getting a card from another bank. However, I took a different approach. I started by getting the Chase Sapphire Reserve card. Soon after, I added the United Explorer card (which is a co-branded Chase Card). However, I knew I was spending a lot on flights, so I opened the Amex Platinum to get 5x points on flights booked directly with the airline (+ take advantage of all the other amazing card features).

When I hit 3/5 slots, I took a more serious look at which cards I wanted to finish out with. I then got the Marriott Bonvoy Boundless® card. As of now, I have 1 slot left. I will likely get the World of Hyatt® credit card to get more free hotel nights and fill the final slot.

My strategy is also influenced by the fact that I have a partner (my Player 2) who can sign up for cards as well. We plan our spending around all our cards collectively.

Final Thoughts

One last thing to keep in mind about Chase cards: you can re-earn a sign-up bonus if it’s been more than 24 months since you last earned a SUB for that card. You do have to close the card and wait at least 30 days before re-opening the card and you have to have a slot open under 5/24 to be eligible.

If Chase cards aren’t the best cards for you or you don’t like their transfer partners, it’s perfectly fine to look elsewhere for a better fit. Just know that once you hit 5/24, you will need to be patient if you change your mind down the line and want to open a card with Chase.

You may also like: