Beware the Fine Print: My Points/Miles Mistakes

One thing that I learned very quickly as I got into the points/miles world is that there are so many deals out there and lots of ways to save money and earn points. You can literally save thousands of dollars each year by playing your (credit) cards right alone. However, not every offer is as amazing as it sounds and those pesky terms and conditions may keep you from getting any benefit at all.

Here are just four examples of mistakes I’ve personally made (or come very close to making) that left me spending more than I expected:

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my link, at no extra cost to you.

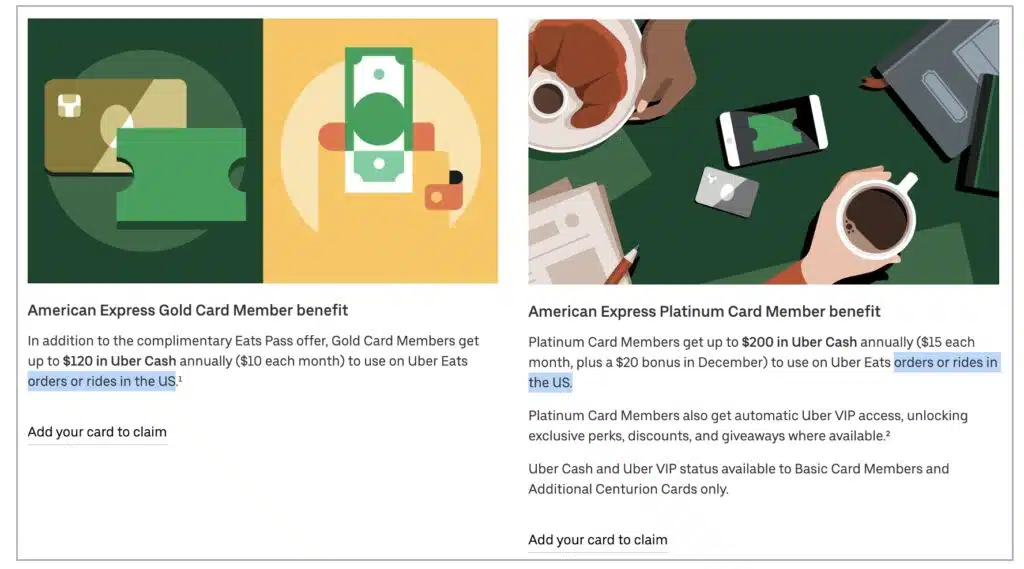

Amex Uber Credit

Amex offers a great benefit on two of its most popular cards. With an Amex Platinum, you get a $15 Uber Cash added to your Uber account balance each month and $35 in December. An Amex Gold card gives you $10 Uber cash each month. Best of all, if you have both cards, you can combine the credits for more cash in your Uber account. This even works if you aren’t the cardholder for both cards – for example, I have the Amex Platinum and Thomas has the Amex Gold, but we send both our Uber credits to my Uber account and just make sure to order Ubers from my phone.

The biggest drawback of this credit is that it’s only available in the United States, which we learned the hard way on our trip to Vancouver. Had we known the Uber credit wouldn’t have been applicable, we would have used Lyft instead and paid with our Chase Sapphire Reserve to get 10x points/dollar.

Thankfully this was a minor mistake and a cheap Uber ride, but knowing the full terms of your benefits can save you frustration in the future and help maximize your points.

Note: these Uber credits are use-it-or-lose it each month, meaning the cash doesn’t roll over from one month to the next.

United MileagePlus Dining

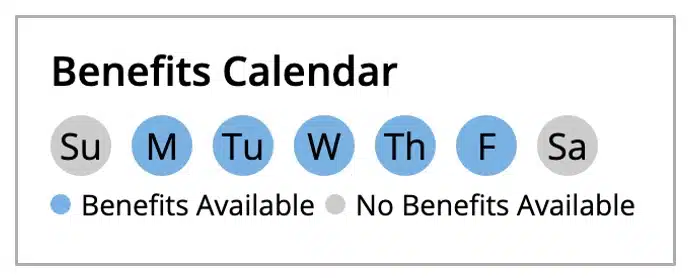

Dining programs are a lesser-known way to rack up airline or hotel points without much effort. All you have to do is sign up for an account, add all your credit cards (so you never accidentally miss out on rewards), and you can earn points by eating at participating restaurants. You can easily search on their website to see which restaurants around you can give you points. It’s largely a set-it-and-forget-it program for me. If I happen to eat at a participating restaurant, great, but I rarely decide where to eat based on it.

There are usually some sort of sign up offers or ongoing ways to earn bonus points if you eat at a participating restaurant within a certain time period. When I signed up, the offer was 3,000 bonus United Miles for spending at least $25 at a restaurant in the first 30 days (in a single transaction). What I didn’t know however, was that even if a restaurant shows that it is part of the program on the website, it may not participate every day of the week. I intentionally ate at a restaurant for breakfast one Saturday morning to get the points only to find out they only offered rewards Monday thru Friday. I ended up having to eat at another restaurant to get my sign-up bonus. This information is easily available on the website, but I just didn’t know I needed to be looking for it.

*Note: if you eat out at restaurants a lot, I recommend making sure you’re using a credit card that earns you extra points when eating out. The Chase Sapphire Reserve earns you 3x points/dollar on restaurants and the Amex Gold earns you 4x points/dollar.

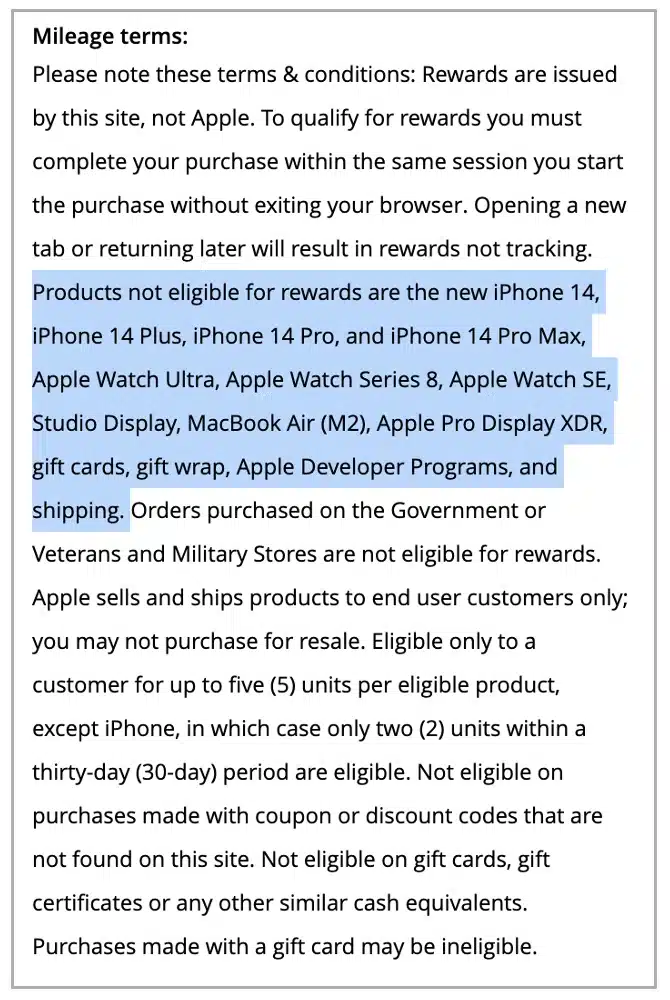

Shopping Portal Exclusions

I’ve touched on shopping portals before and how they can be a great way to easily rack up extra points for the online shopping you’re already doing. If you have a big purchase coming up and you see a store offering multiple points/dollar on a shopping portal, it may seem like a great opportunity to earn serious points. It’s important to take the time to read the fine print at each store. For example, I want to buy the new iPhone 14 Pro at the Apple Store online. A quick look at the terms shows that a purchase of all the newest Apple products, from phones to watches, are not eligible for the extra miles. Neither are gift cards.

Thankfully, I saw the fine print before I lost out on points. There is also a workaround if you want the latest gear and the points. On the Mileage Plus X app, you can buy Apple gift cards and earn 2 United miles/dollar (+ a 25% bonus if you hold a United credit card). I only recommend this if you’re certain you’ll use the gift card up so you don’t end up with money to a store you don’t shop at.

AAA Hotel Rate

I have been a AAA member since I got my license in high school and the roadside assistance alone makes it worth it for the peace of mind. The AAA card can also earn you discounts on travel, including lower hotel rates. Unfortunately, those lower rates may subtly mean losing out on other benefits.

For example, when we visited Vancouver, I booked a stay at Hotel BLU. They had a deal going on that if you booked directly on their website, you’d get free breakfast included. We didn’t find out until we checked in that we were made ineligible for this offer by booking the AAA rate. The AAA discount was minimal and certainly less than the cost of breakfast for two people, so this was frustrating discovery day-of.

MileagePlus X App

This isn’t even a case of not reading the fine print, just a weird fluke in the system to know about. When I purchased an Airbnb gift card in the MileagePlus X app with my Chase Sapphire Reserve, it coded as a travel expense and I earned 3 points/dollar with Chase. Because that worked without a hitch, I bought a Starbucks gift card on the app with my Amex Gold card and assumed I’d get 4 points/dollar, just like I would at any restaurant or grocery store with that card. Unfortunately, when I checked my statement, I learned that it coded as “shopping” and just gave me the base rate of 1 point/dollar. A quick Google search led me to a very helpful article from The Points Guy that explained that for some unknown reason, Chase card purchases on the MileagePlus X app code as the category of the store the gift card is for (ex. Starbucks is a restaurant, Airbnb is travel, etc.) but Amex card purchases all code as shopping. Lesson learned and I will either be avoiding the MileagePlus X app for restaurants in the future or at least using my Chase Sapphire Reserve instead, which earns 3 points/dollar on dining (which when combined with the bonus points from the app can be more valuable than the Amex Gold’s 4 points/dollar).

The Bottom Line

Points & miles isn’t always easy and I’ve seen even the experts make mistakes. Educating yourself and carefully reading the fine print are a great way to minimize chances of surprise charges. It’s worth slowing down and ensuring you understand the scope of the promotion. When you do make mistakes, take a deep breath, learn from it, and move on. There are always more points to be earned!

You may also like: