What’s Important to Think About Before Adding Authorized Users

The concept of credit card authorized users was something I only kind of understood when I was starting out in points & miles. A lot of couples will say they have “joint credit cards,” but unlike bank accounts, you can’t be equals on a credit card. One person has to be the primary account holder and the other can be added as an authorized user.

When my husband got his first credit card, he added me as an authorized user (AU) without a second thought. While that was fine, we are now pickier on when we add each other as AUs. There are pros and cons, so it’s important to think through the following factors before adding any authorized users.

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my link, at no extra cost to you.

What is an Authorized User?

Simply put, an authorized user is someone you add to your credit card account. They receive their own physical card with their name on it. At most banks, the number on the card is the same as the primary account holder. The authorized user won’t be able to log in online and see transactions and they can’t call the bank with any questions or concerns – that all has to be done by the primary user.

Credit card issuers have different limits, but often someone has to be a minimum of 13-16 years old to be an authorized user. No credit check is run to add an authorized user and they don’t have to be related to you. You can have your spouse, child, friend, employee, etc. as an authorized user if you wanted to (though it’s not always a good idea – we’ll get into that).

It’s also important to know that even if you’re an authorized user on a card, you’re still eligible to apply for that same card on your own at any time and earn the welcome offer.

BENEFITS OF ADDING AUTHORIZED USERS

Helps Build the Authorized User’s Credit

If you have good credit and can responsibly make payments on time, you can help give your children a leg up by adding them as an authorized user to one of your credit cards when they’re old enough. I can’t thank my parents enough for doing this for me and allowing me to have a nearly 800 credit score right out of school.

One of the criteria in determining a credit score is length of credit history, so most young people have virtually 0 years of credit history when they’re just starting out. According to my credit report, I have 36 years of credit history, despite only being 26 years old! Now, if I was removed as an authorized user from that old card, my length of credit history would plummet. So, although I never use that card for spending, my parents will never remove me as an AU. On the flip side, if you’re a parent adding your child, make sure you’re adding them to a card you intend to keep in perpetuity (a free or low-annual fee card are great for this).

This strategy is also good if you want to help someone rebuild bad credit. If you don’t trust them with their spending, you can always keep the physical card and number to yourself and they will passively build credit as you practice responsible spending. Of course, never do this without their permission!

Some Benefits Extend to Authorized Users

I rarely fly American Airlines, so I have no status or co-branded credit cards with them. However, on the rare occasions I do fly with them, I always have access to the Admirals Clubs because I am an authorized user on my dad’s AA credit card.

Every card differs in what perks extend to authorized users, so make sure to do your research before adding someone to your card.

Here are some examples of benefits that extend to additional card members:

- Many cards, including the Chase Sapphire Reserve and Capital One Venture X extend lounge access to authorized users (and they can bring guests).

- Rental car insurance, purchase protection, cell phone protection, etc. extend to authorized users.

- Capital One Venture X authorized users receive Hertz President’s Circle elite status.

- Additional users for an Amex Platinum card are eligible for their own $100 statement credit for TSA Pre Check/Global Entry. This goes for both the free Gold card and the $175 Platinum card authorized users.

Ability to Transferring Points to Other Accounts

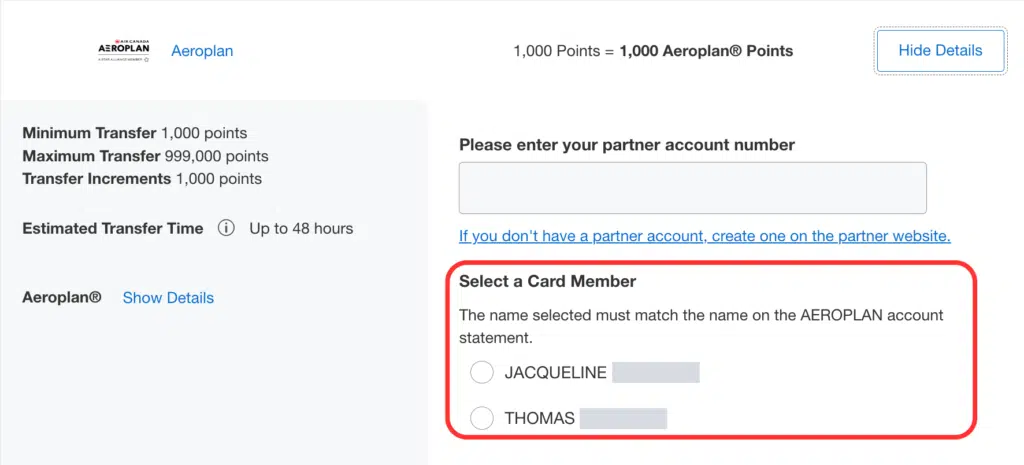

For credit cards with transferrable points (ex. the Chase Sapphire Reserve, the Amex Platinum/Gold, or the Capital One Venture X), you can transfer points to the airline/hotel accounts of authorized users.

For Amex, you have to wait 90 days after adding an AU before you can transfer points to them, so plan ahead if you want to do this.

Some banks allow you to transfer points to anyone in your household. In that case, adding them as an authorized user isn’t necessary. Chase allows this, but the first time you want to make the transfer, you have to call them.

Here’s an example of when being able to transfer points across accounts is important. Say you and your mom want to book a trip together on points. Your mom has a United credit card, status, and some United points in her account but not enough to book a trip. That United card gives her access to extended award availability, so you want to book through her account. You have some Chase Ultimate Rewards points to contribute towards the trip. If you add your mom as an authorized user, you can transfer your Ultimate Rewards points to her United account and have enough points to book the trip. By booking together you access the extended award space and any status benefits (ex. free checked bags, priority upgrades, etc.)!

Easier to Hit the Minimum Spend for Welcome Offers or Status

Obviously 2 people putting purchases on a card will add up more quickly than just 1 person. If you’re working towards a welcome offer, it may be easier to reach with an authorized user. Of course, this isn’t necessary to hit a SUB, but can be helpful for some. Each person physically having their own card can be helpful if you shop separately so you can always have the right card on hand (though online shopping and Apple pay can minimize the necessity of physical cards).

My points/miles journey technically started in 2019 when Thomas signed up for a Southwest Rapid Rewards credit card right after we got engaged and added me as an authorized user. This was our only credit card for years and we put all of our spending on this card. All the points earned went to Thomas’s Rapid Rewards account and between moving across the country, buying and furnishing a house, travel, and planning a wedding, we earned enough points for Thomas to get the coveted Southwest Companion Pass that has allowed me to travel for free* on Southwest Airlines 4 years in a row. (*free = just paying taxes, which is only $5.60 per domestic flight).

[RELATED: All About the Southwest Companion Pass]

Bonus Points

Some cards will offer bonus points for adding additional users to your account. These are usually targeted offers, but if you’re on the fence about adding someone, 10,000 points (or more) just might sweeten the deal. There is usually a spending requirement as part of the promotion, just like signing up for a brand-new credit card. Though they come and go, I see these offers on my Amex cards often, so don’t feel obligated to jump on the deal when you see it. You can wait until you’re ready.

Simplicity

The world of points & miles can be overwhelming, especially at first. Having only one credit card account means only having to log in to one place to monitor your spending, pay off your card, manage your points, etc. You only have to manage one set of benefits. If you’re a beginner, this is a great starting place as you get comfortable with points/miles.

THE CASE AGAINST AUTHORIZED USERS

Being an Authorized User Takes a 5/24 Slot

If you’re serious about points & miles and are signing up for new credit cards often, you’ll want to be cautious of being added as an authorized user. Doing so will take up one of your Chase 5/24 slots (not sure what that means? Get the details here).

If you are removed as an authorized user, you can call the credit bureaus and have it removed from your credit, freeing up a slot. It’s a little extra leg work, but can be well worth it.

When racking up the most points possible in a short time is your goal and you have a “Player 2”, the 5/24 Rule becomes a big factor in strategy. If you fall into this camp, I’d recommend signing up for a card, earning the SUB, and then referring your partner to the same card so when they hit their SUB, you get a referral bonus.

[RELATED: Chase 5/24 Rule Explained]

You’re Responsible for Authorized user Spending (Only Add People You Trust!)

Every dollar an authorized user spends is connected to your account, and you are responsible for paying off the card. This can be good if you and your partner just want to simplify finances, but can be dangerous if you can’t trust your authorized user’s spending. As I mentioned before, you can always throw their card in a drawer, but they won’t have access to any perks that require them to show their card or pay with it.

Some cards do allow you to set spending limits for authorized users, as low as $200. This is common for business credit cards, but Amex allows you to control spending on personal cards as well.

It Sometimes Costs Money to Add Authorized Users

With a lot of credit cards, it’s free to add an authorized user. However, for some, doing so comes with an annual fee.

Here’s an example. The Amex Platinum card has 2 versions of authorized user cards: a free Amex gold card (that is not the same as the normal Amex Gold!) and an Amex Platinum that comes with a $175 annual fee. Only the latter will allow authorized users access to the Centurion Lounges. While the price is steep, it’s valid for up to 3 authorized users (meaning whether you have 1 authorized user or 3, you’ll pay $175 per year).

Most cards are more straightforward than the Amex Platinum and they either charge for AUs or they don’t. There’s rarely a choice like there is with this card.

If it costs money to add an authorized user, you’ll want to be extra sure that the benefits of adding them outweighs the costs. If you’re paying $175 to add someone as an Amex Platinum AU, that cost-benefit analysis may factor in how many times per year they will access Centurion Lounges or if they’re taking advantage of the TSA Pre Check/Global Entry credit.

[RELATED: How to make money on high fee credit cards]

Final Thoughts

If you’re wanting to dive deep into points & miles in “2 Player Mode”, I wouldn’t automatically add your partner as an authorized user. Consider what your reasons are for doing so and if the benefits outweigh the drawbacks. More than anything, remember there can be serious financial ramifications if you add someone you can’t trust, as you’ll be left on the hook for their spending.

As with so much of the points & miles world, adding authorized users is a strategic game that is going to look different for each person. Just like there’s no one best credit card for everyone, there’s no one best way to add authorized users. Find what works for you!

You may also like: